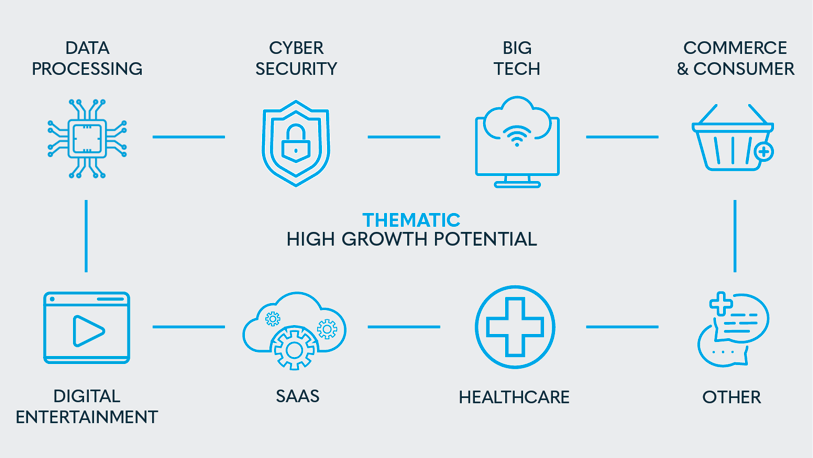

It has been a volatile year so far for global markets. From Trump’s tariff threats and tensions in the Middle East, to AI breakthroughs and cyber attacks, investors have had no shortage of headlines to digest. Yet despite this noise, High Street’s Wealth Warriors strategy has remained focused on its mission of identifying the companies advancing technological innovation and delivering long-term capital growth. It uses a top-down thematic approach, homing in on industries that aren’t just growing, they are transforming the way we live and work. Year-to-date, the strategy has gained 17.4% in US Dollars, outperforming the MSCI All-Country World (+3.5%) and Nasdaq (+4.4%) indexes.

One of the clearest drivers has been our Cybersecurity theme, which we covered in depth last month. As ransomware attacks, AI-powered phishing and data breaches become more common and more costly, cybersecurity protection has become a non-negotiable cost of doing business. Companies like Cloudflare (+77%), CrowdStrike (+48%), and Zscaler (+74%) are driving this crucial technology, and the sector remains one of the strategy’s largest exposures. Semiconductors has also been a key factor this year as the rapid rise of Large Language Models has created insatiable demand for compute power. NVIDIA (+15%), AMD (+19%), and ASML (+15%) are some of the companies at the forefront of this surge. We’re also seeing compelling performance from our Commerce & Consumer and Digital Entertainment themes, through names like Mercado Libre (+51%) in Latin American e-commerce, Symbotic (+57%) in warehouse automation, and Spotify (+74%) in music streaming. These scalable platforms are benefiting from fundamental, long-term changes in how people shop, work, and spend, allowing them to consistently grow their earnings and expand market share.

However, while our exposure to these sectors has been the primary engine of returns, other themes like Big Tech and Software-as-a-Service have struggled this year. This kind of dispersion is not unusual, and it provides an important reminder of the advantages of diversification within a strategy. Disruption is very rarely smooth or linear, but we believe a disciplined, long-term approach remains the most effective way to harvest the powerful returns of technological innovation. For South African investors, accessing the Wealth Warriors strategy is extremely straightforward. It is available overseas in Dollars or listed locally in Rands, giving local investors exposure to global growth regardless of currency.

Unless otherwise stated, all performance and statistical figures provided in this article have been pulled from Bloomberg by the High Street Asset Management Research Team on 27 June 2025 and all the images provided in this article have been sourced from FreePik and have been used in line with their Acceptable Use Policy. The contents of our newsletters are frequently sourced from or verified through our various product providers and other third parties. Although every effort is made to ensure the accuracy of the information contained in the newsletter, it should not be construed as financial advice as defined in the Financial Advisory and Intermediary Services Act. Links are provided to third-party websites for convenience only. High Street Asset Management (Pty) Ltd cannot accept responsibility and does not endorse any information contained on a third-party site. For our full disclaimer, please see: https://hsam.co.za/legal/.