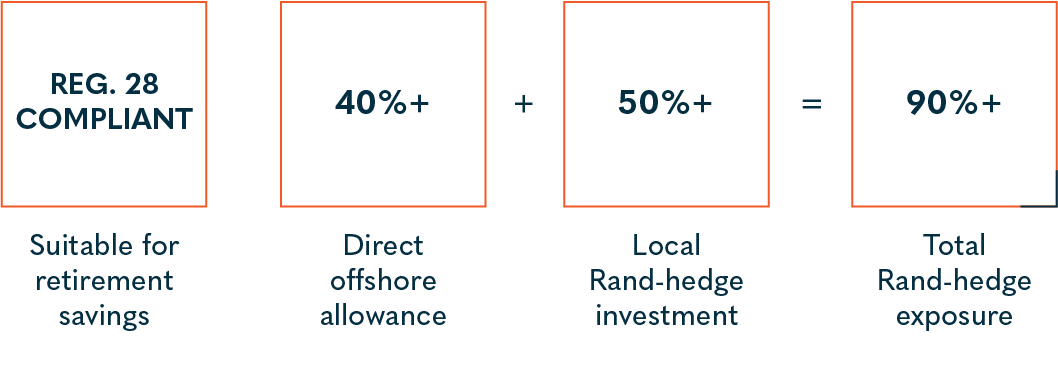

Ideally suited for retirement savers looking to diversify from local risks. Reg.28 compliant fund with 90%+ Rand-hedge exposure.

Ideally suited for retirement savers looking to diversify from local risks. Reg.28 compliant fund with 90%+ Rand-hedge exposure.

Download our simple guide, everything you need to know about the High Street Balanced Prescient Fund.

The Fund’s 90%+ Rand-hedge bias means that its volatility is largely driven by significant movements in the Rand exchange rate, rather than the risks associated with its underlying investments.

Curious about how the High Street Balanced Prescient Fund can enhance your portfolio? Let us create a personalised Return vs Volatility report tailored to your current holdings.

High Street Balanced Prescient Fund

Updated quarterly (last updated 30/06/2025)

This resource aims to equip investors with the tools and insights needed to confidently integrate this high-performing, yet highly differentiated Fund into client portfolios. Understand how this Regulation 28-compliant solution with a track record of outperformance could potentially enhance portfolio diversification and long-term returns.

Available on most major platforms and for employee benefits.

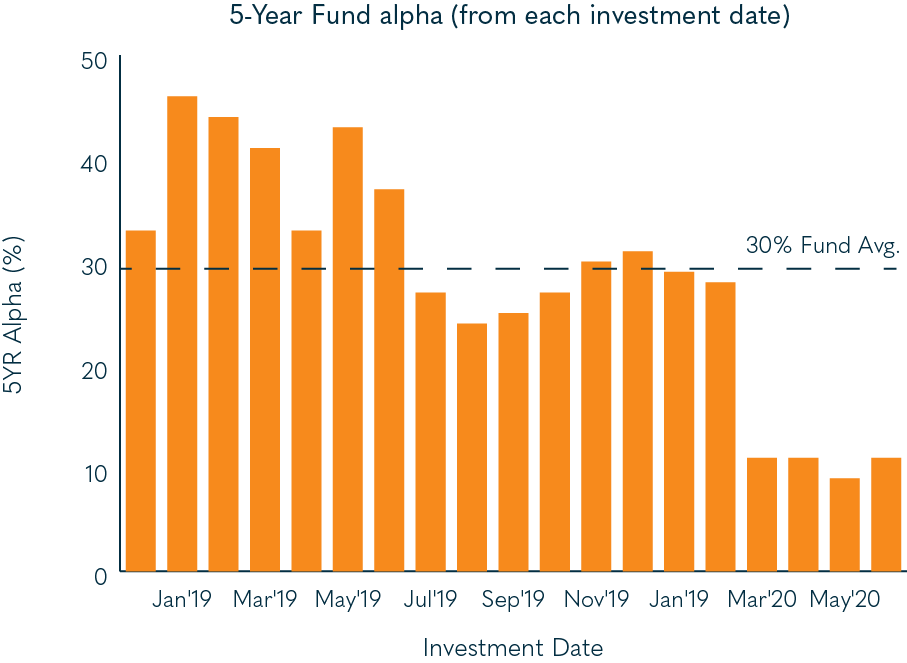

The High Street Balanced Prescient Fund has delivered exceptional 5-year alpha across varying investment dates, averaging 30%. This chart highlights the Fund’s consistency in outperforming its benchmark. Its strong offshore focus and 90%+ Rand-hedge mandate make it a powerful tool for advisers seeking to diversify portfolios.

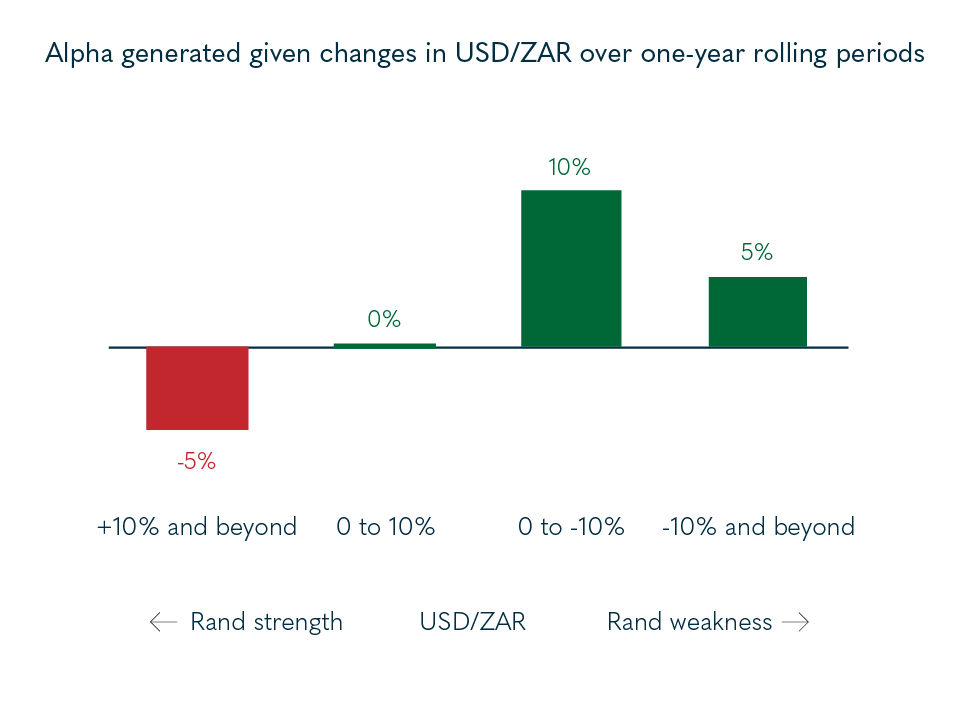

This chart illustrates how the High Street Balanced Prescient Fund has consistently added alpha across various USD/ZAR currency movements. While Rand strength (+10% and beyond) results in underperformance (-5%), the Fund thrives during periods of Rand weakness, delivering up to 11% alpha in depreciating environments.*

Source: High Street Asset Management, Bloomberg, 30/06/2025*

“This Fund’s consistent outperformance during periods of Rand depreciation makes it an essential diversification tool for advisers managing South African retirement savings.” Ross Beckley, CIO